rsu tax rate india

Listed below are some of the benefits of restricted stock units you need to consider. Please note that if your RSU income is taxed above 22 when your taxes are filed depending on your other tax withholdings you may owe additional taxes when you file.

Tax In India On Income Earned From Rsu Vested In Foreign Countries And Exemption From Such Income Taxontips

Carol Nachbaur April 29 2022.

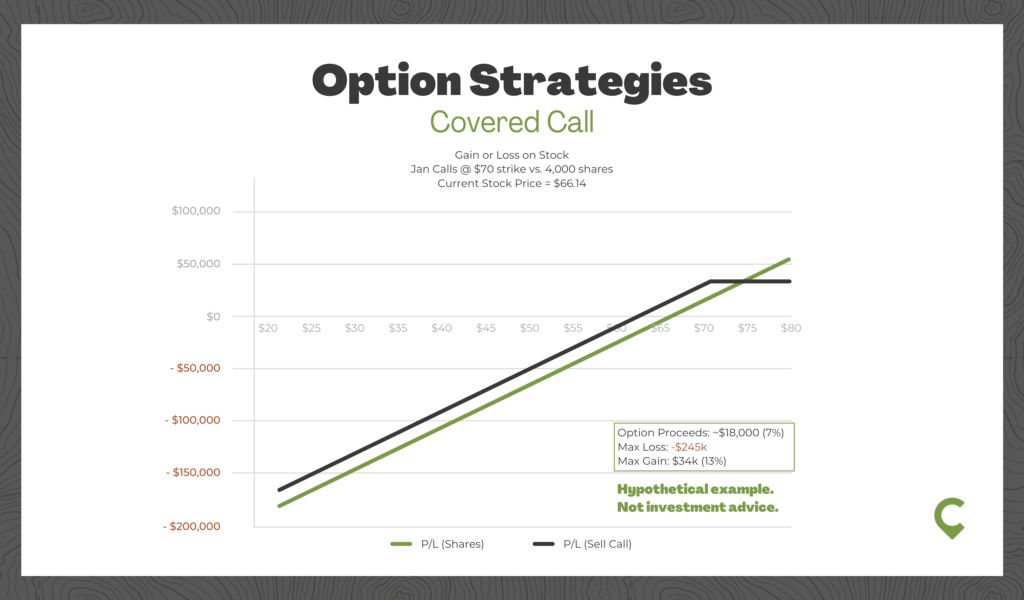

. 10003 Restricted Stock Units 10003 Stocks listed on Foreign Stock Exchanges. The capital gains tax rate when you. At any rate RSUs are seen as.

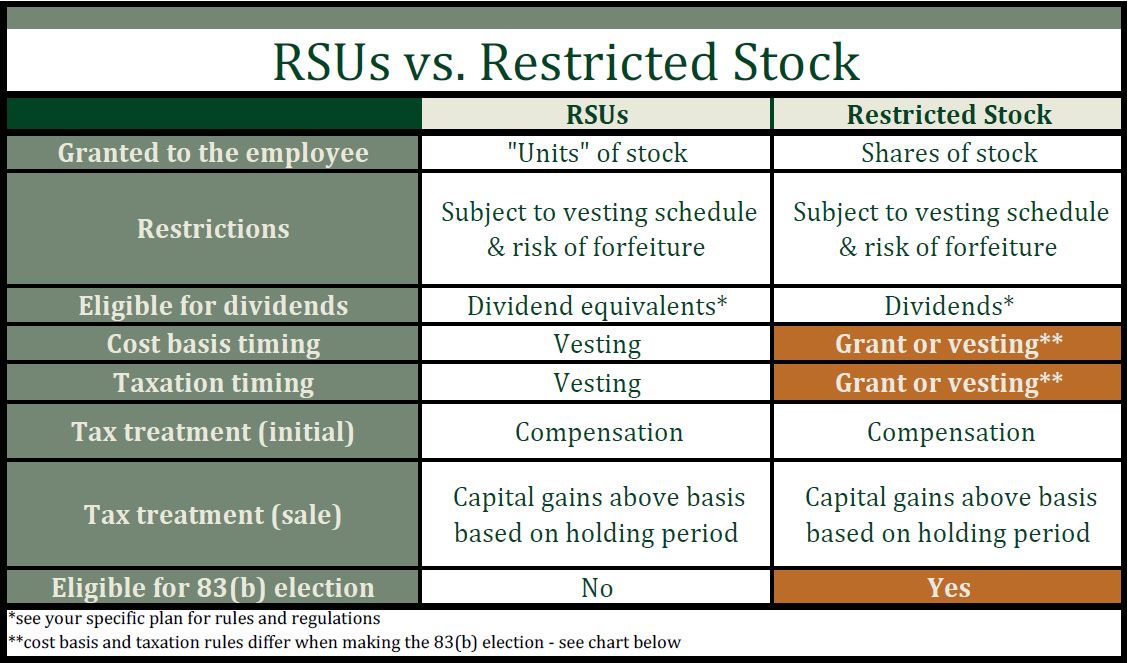

Also restricted stock units are subject. RSUs are taxed as ordinary income thus the rate that the recipient may pay can range from 10 to 37 depending on the recipients household income. Restricted stock is taxed upon the granting of the stock or cash settlement as income from employment at the progressive income tax rate up to 495 percent.

As per the tax laws of India sections 90 and 91 of the Income-tax Act deal with the concept of FTC. Since in your case the RSUs are listed on NASDAQ and not on any Indian Stock Exchange they are unlisted securities wrt Indian Direct Tax law. For STCG where the securities transaction tax is applicable the applicable tax rate is 15 surcharge and health and education cess.

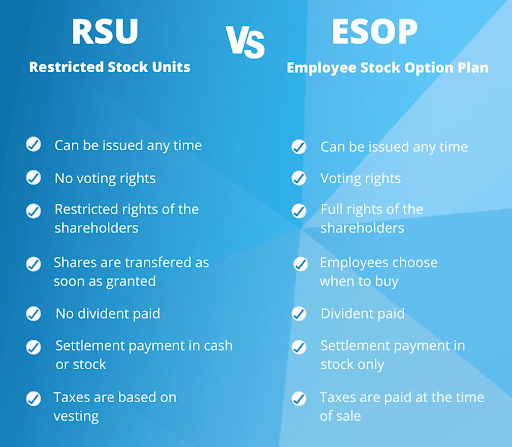

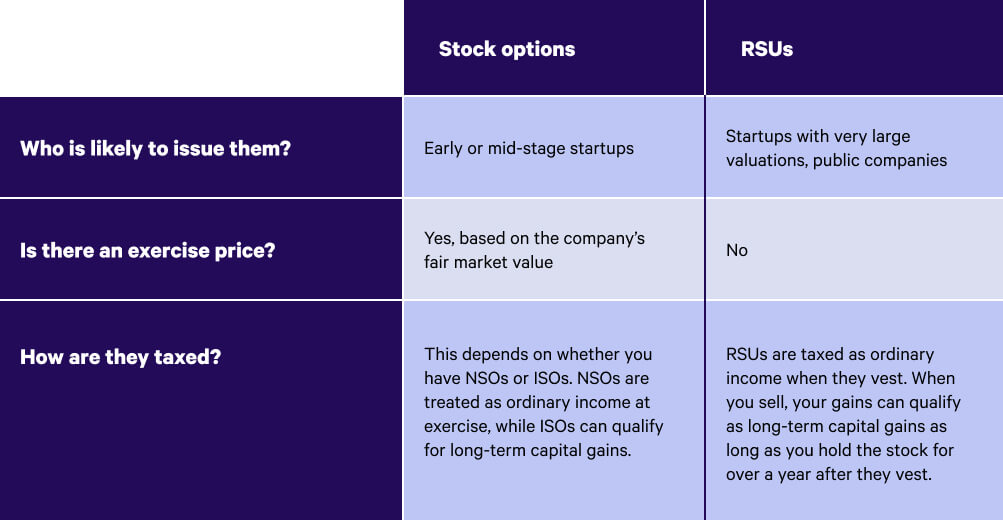

The stock is restricted because it is subject to certain conditions. So you have to pay tax on all Rs 1 lac however if its RSU of a public listed Indian company your tax will be NIL because of long term capital gains but if its a out side india. Restricted stock units RSU are not taxed like stock options.

Restricted stock and RSUs are taxed upon delivery and subject to progressive income tax up to 56 percent. Many employees receive restricted stock units RSUs as a part of. Restricted stock is a stock typically given to an executive of a company.

Thus the 2000 was. What are the taxation rules for RSUs in India. On the day if vesting 30 of the amount stocks are withheld and paid as tax to indian gov.

On the other hand the rate for short term gains is the same as. Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs. Click here now to learn how they work how they are taxed and how to report them in 2022.

How it works in Google MicrosoftAdobeAmazon Walmart and what will be effective tax on allocated RSUs. RSU Taxes - A tech employees guide to tax on restricted stock units. RSUs offer several benefits to a companys employer and employees.

RSUs are taxed upon the. Tax treatment of RSUs in India The RSU. If you hold the RSUs for more than 3 three.

You can claim the credit of taxes paid in US while filing ITR in India. For one a recipient cannot sell or. Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer.

Carol nachbaur april 29 2022. Learn more about meaning and taxation of RSU ESOP ESPP. Some RSU receivers might opt to pay for the tax owed via personal check or would prefer the tax withhold via deduction of their paycheck.

If you live in a state where you need to pay state.

Restricted Stock Unit Rsu What It Is How It Works Seeking Alpha

Rsu Taxes Explained 4 Tax Strategies For 2022

Must Knows About Restricted Stock Morningstar

Taxability Of Esop Rsu And Espp For Indian Residents Youtube

Restricted Stock Unit Rsu Taxation Stay On Top Of Your Tax Withholding Lifesighted

All About Rsus Shares Taxes Applicable What Happens After 4 Years Truth Behind Rsus Youtube

/GettyImages-655242786-038f5688f69840899bc4f35415351106.jpg)

How Restricted Stock Restricted Stock Units Rsus Are Taxed

Rsus Vs Stock Options What S The Difference Wealthfront

Navigating Your Equity Based Compensation Restricted Stock Restricted Stock Units Verum Partners

Tax Accounting Xperts Ilead Tax Llc

Employee Stock Purchase Plan Or Espp

Rsus Can Make For A Shocking Tax Bill Without Proper Planning Summitry

You Re Getting Double Taxed On Your Rsu How To Avoid Restricted Stock Units Double Tax Youtube

Rsu Stock How They Work How They Re Taxed 2022

Don T Pay Tax Twice On Rsu Sales Parkworth Wealth Management